We thought that maybe this roadmap model will be useful to you at some point. But what is a road map and why do we need it if we have a car registered to the company or borrowed.

What is a roadmap?

The road map has become a mandatory tool to justify the full deduction of fuel expenses, starting from July 1, 2012.

Until this date, it was not mandatory to use this document to justify fuel expenses, although in practice it was used by many companies.

If the car is not fully used for the purpose of the economic activity, it is not mandatory to prepare this document.

The methodological norms in art. 298 of the Fiscal Code provides that in order to exercise the right to deduct the tax, any taxable person must have the documents provided by law for the deduction of the tax and draw up the roadmap which must contain at least the following information:

- category of used vehicle

- purpose and place of travel

- kilometers traveled

- own fuel consumption rate per kilometer traveled.

Therefore, if the tax deductibility of 100% is applied, the roadmap is additionally prepared, with the elements mentioned above. Of course, there must be invoices, receipts that have the company's CUI written on them, proof of payment - VAT upon collection.

The use for the purpose of the economic activity of a vehicle includes, but is not limited to:

- trips in the country or abroad to customers/suppliers, for market prospecting

- trips to locations where there are work points, to the bank, to customs, to post offices, to tax authorities,

- the use of the vehicle by the driving staff in the exercise of their duties

- trips for intervention, service

- repairs

- use of test-drive vehicles by car dealers.

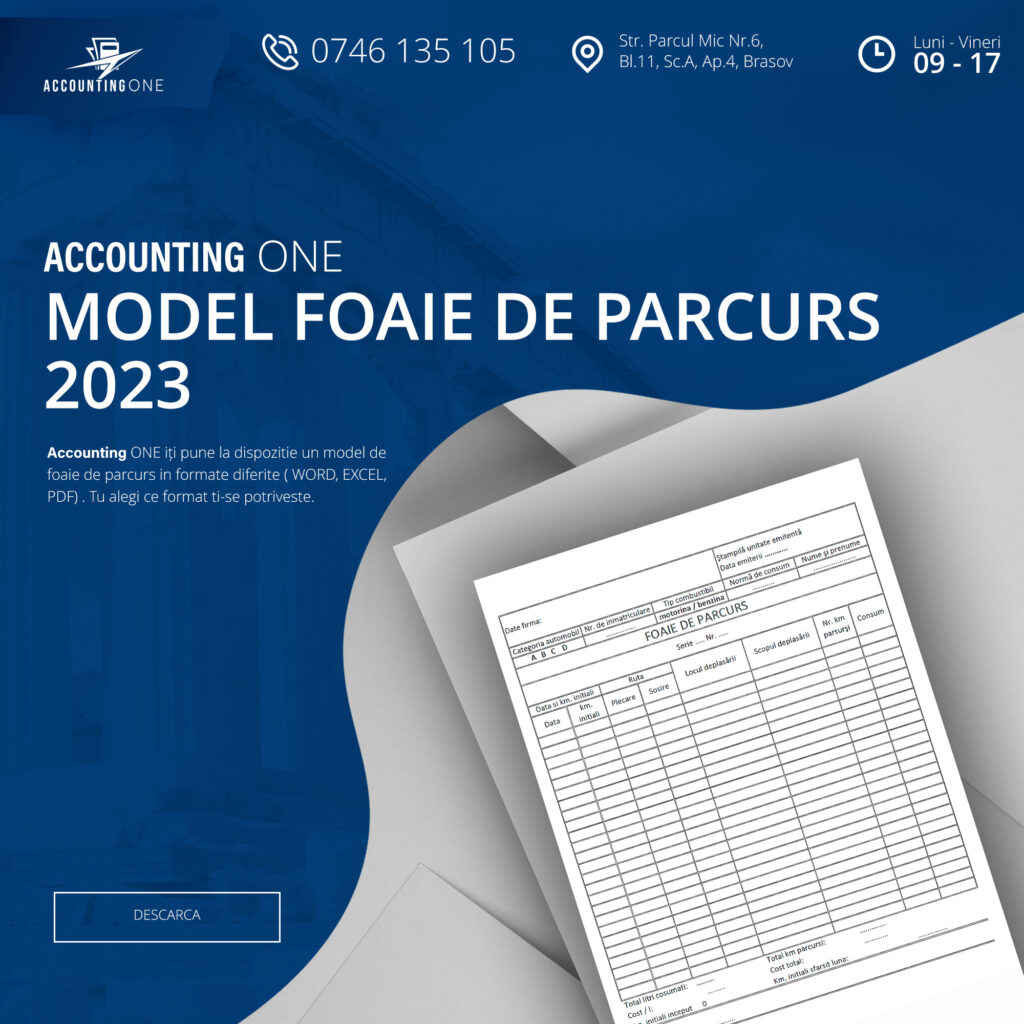

Download roadmap template Word, Encel, PDF

Smart entrepreneurs choose a accountant Brașov that offers more than numbers. Choose Accounting One and transform accounting into a growth tool.

FAQ

The roadmap is a document used for tracking and justifying employee delegations which involves business travel. Includes information about destination, purpose, kilometers traveled, and expenses.

The model is offered in Word, Excel and PDF, facilitating adaptation and use according to companies' internal procedures.

Yes. The sheet complies with legal provisions regarding the documentation of delegations, including the details necessary to justify the accounts.

All entities that send employees on delegations: LLCs, PFAs, NGOs, public entities, SMEs, etc.

For digital distribution

Useful in situations where the text does not change

Send the document as a fixed, compliant and legible sheet.